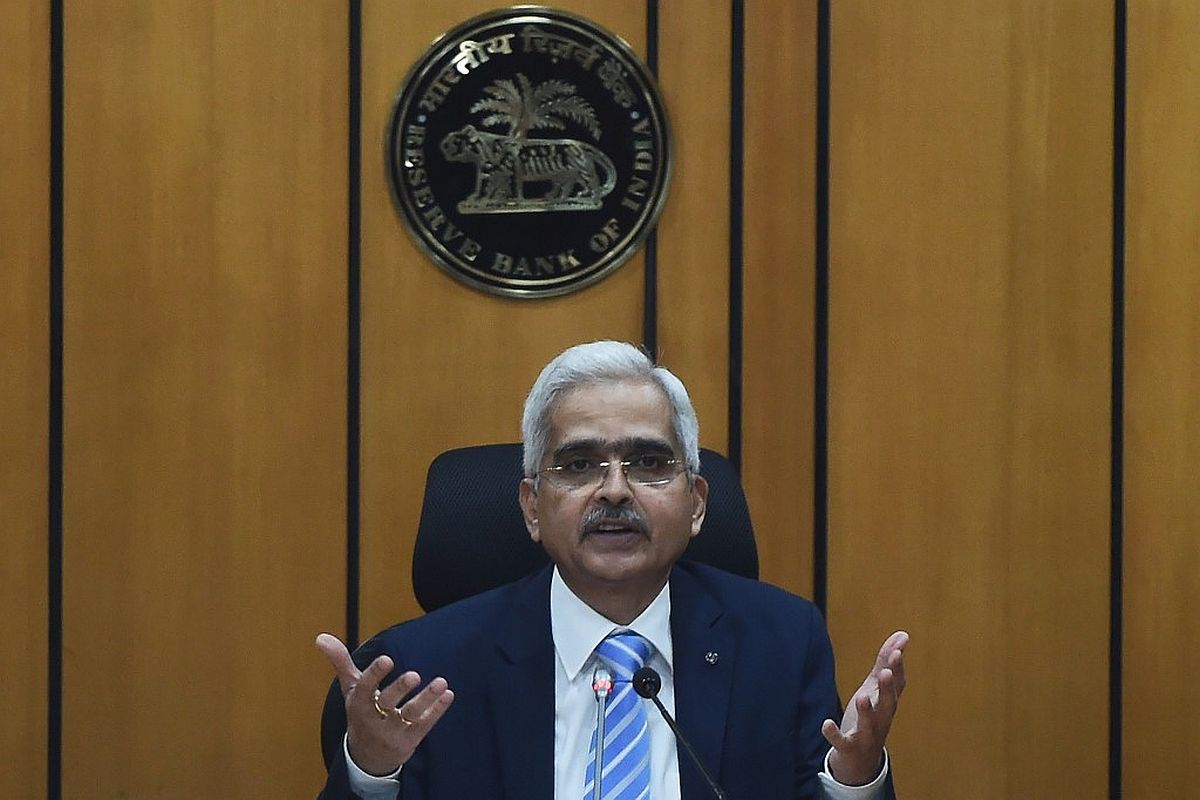

Reserve Bank of India (RBI) Governor Shaktikanta Das Sunday said the establishment of digital banking units (DBUs) will further augment the digital infrastructure in the country and improve customer experience in doing banking transactions.

Prime Minister Narendra Modi today dedicated 75 DBUs to the nation. Finance Minister Nirmala Sitharaman, in her Union Budget speech for 2022-23, had announced setting up of 75 DBUs in as many districts of the country to commemorate 75 years of India’s independence.

DBUs are being set up by commercial banks to ensure that the benefits of digital banking reach every nook and corner of the country. It is a joint initiative of the government, the RBI, the Indian Banks Association and the participating banks.

“The establishment of DBUs is a step to further augment the digital infrastructure in the country. This will act as an enabler in the digital ecosystem and will improve customer experience by facilitating seamless banking transactions,” Das said at the virtual launch of these DBUs.

These units will augment the efforts to promote financial inclusion by providing banking services in a paperless, efficient, safe and secure environment, he said.

The DBUs will provide specific financial services which include savings, credit, investment and insurance. On the credit delivery front, they will provide end-to-end digital processing of small ticket retail and MSME loans, starting from online applications to disbursals.

Das said the products and services in these units will be provided in two modes – self-service and assisted modes – with self-service mode being available round the clock.

DBUs will enable customers to have cost effective, convenient access and enhanced digital experience of banking products and services. They will spread digital financial literacy and special emphasis will be given to customer education on cyber security awareness and safeguards.

Das said banks are also free to engage the services of digital business facilitators and business correspondents to expand the footprint of DBUs.

He said in recent years, digital banking has emerged as a preferred channel for delivering banking services in the country and the Reserve Bank has been taking progressive measures to improve availability of digital infrastructure for banking services

Meanwhile, private sector lender ICICI Bank said it has set up four DBUs which are in Dehradun (Uttarakhand), Karur (Tamil Nadu), Kohima (Nagaland) and Puducherry.

HDFC Bank said it has opened four units – one each in Haridwar, Chandigarh, Faridabad and South 24 Parganas (West Bengal). Axis Bank said it has opened one unit in Itarsi (Madhya Pradesh) and another two in Bundi and Bhilwara (Rajasthan).

State-run Union Bank of India said it has operationalised six DBUs – Rajahmundry and Machilipatnam (Andhra Pradesh), Palakkad (Kerala), Sagar (Madhya Pradesh), Nagpur, Agartala.

Bank of Baroda has opened eight DBUs in Indore, Kanpur Dehat, Karauli, Kota, Leh, Silvassa, Vadodara and Varanasi.